cerrajerosgetafe24horas.site

Gainers & Losers

High Credit Score Mortgage

In general, a credit score above will allow potential mortgage borrowers access to prime or favorable interest rates on their loan. Your credit score directly affects the interest rate on your mortgage. Basically, high credit scores lower your interest rates, while low scores cause them to. A credit score between and is needed for a home loan, but a higher credit score will lead to a lower mortgage interest rate and monthly payment. A higher credit score indicates that you're a lower-risk borrower, which could lead to a lower mortgage rate over the life of the loan. While different lenders have their own standards for rating credit scores, scores above the high s (on a scale of to ) are generally considered. Yes, you can get a mortgage with a credit score of This score sits between a Fair and Excellent credit rating, depending on which credit reference agency. A credit score of or above is generally considered good. A score of or above on the same range is considered to be excellent. To improve this ratio: pay off debts, especially those close to maxing out. To receive the best FICO mortgage rates: keep your debt utilization ratio under 30%. A higher score increases a lender's confidence that you will make payments on time and may help you qualify for lower mortgage interest rates and fees. In general, a credit score above will allow potential mortgage borrowers access to prime or favorable interest rates on their loan. Your credit score directly affects the interest rate on your mortgage. Basically, high credit scores lower your interest rates, while low scores cause them to. A credit score between and is needed for a home loan, but a higher credit score will lead to a lower mortgage interest rate and monthly payment. A higher credit score indicates that you're a lower-risk borrower, which could lead to a lower mortgage rate over the life of the loan. While different lenders have their own standards for rating credit scores, scores above the high s (on a scale of to ) are generally considered. Yes, you can get a mortgage with a credit score of This score sits between a Fair and Excellent credit rating, depending on which credit reference agency. A credit score of or above is generally considered good. A score of or above on the same range is considered to be excellent. To improve this ratio: pay off debts, especially those close to maxing out. To receive the best FICO mortgage rates: keep your debt utilization ratio under 30%. A higher score increases a lender's confidence that you will make payments on time and may help you qualify for lower mortgage interest rates and fees.

It's recommended that homebuyers have a credit score of at least A credit score of or more is typically considered a “very good” credit score and. Most loans require a credit score of or higher to qualify, though certain loan types are more lenient toward lower credit scores. A credit score is usually considered "excellent." Find out what mortgage rates you might receive with a rate within this range. Higher credit scores generally mean lower interest rates on mortgages and car loans. For these big purchases, savings can amount to thousands (or tens of. In general, a credit score above will allow potential mortgage borrowers access to prime or favorable interest rates on their loan. The higher your credit score, the lower your interest rate may be on a mortgage or any other type of loan. A lender will feel more confident issuing a mortgage. As we mentioned, if you have a high credit score, you traditionally will get a more competitive rate on your mortgage. On the other hand, having a low credit. A credit score above is considered excellent and gets you the best home loan rates, according to the online financial site NerdWallet. Under the new rules, high-credit buyers with scores ranging from to above will see a spike in their mortgage costs – with applicants who. Generally speaking, the higher your credit scores are, the easier it will be to get a mortgage. Higher credit scores will also qualify you for lower interest. A credit score between and is needed for a home loan, but a higher credit score will lead to a lower mortgage interest rate and monthly payment. In this article we'll be reviewing the best lenders for high credit scores and discussing what to look for in a good mortgage lender. A score of or above is generally considered very good, but you don't need that score or above to buy a home. Credit scores are maintained by the national. FICO, myFICO, Score Watch, The score lenders use, and The Score That Matters are trademarks or registered trademarks of Fair Isaac Corporation. Equifax Credit. With a , you should qualify for good rates. Your credit rating will drop when you initially apply and open a new mortgage, and over the next. A good credit score for a mortgage loan typically falls in the range of or higher. However, it's important to note that credit score. Simply put, the higher your credit score, the lower your interest rate, all else equal. And the more loan options you'll have. So be sure to get it right! Which. Very good () – Your credit score may have a minimal impact on your interest rate. You could be offered interest rates % higher than the lowest. To improve this ratio: pay off debts, especially those close to maxing out. To receive the best FICO mortgage rates: keep your debt utilization ratio under 30%. Ask a relative who has a high credit score to help you get approved for your mortgage. Every lender has different rules for co-signers, so check to make.

Crm News

CRM Analytics · Business Intelligence · Data Culture · Data Visualization · Data All News, Corporate News, Earnings News. All News. 09/05/ Salesforce. Pipeliner Announces the Release of Kepler and New Project Management Capabilities to Increase CRM Productivity LOS ANGELES, CA. (SEPTEMBER 2, ) –. Stay up-to-date on Salesforce, Inc. Common Stock (CRM) news with the latest updates, breaking headlines, news articles, and more from around the web at. Capsule Blog. Product news and industry insights from Capsule. Categories. Latest News · Product · Sales · Business · CRM · Marketing · Culture · Webinars. Find Salesforce Inc (CRM) news, corporate events, press releases, latest company updates and headlines. CRM | Complete Salesforce Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Find Customer Relationship Management (CRM) resources here: news, analysis and case studies on CRM software choices and implementing CRM. Salesforce (CRM) · After Hours PM ET 09/05/ $ %. Previous Close · $ · ; % · Volume: Mil · Volume % Chg: 6% · Get a. Get Salesforce Inc (CRM) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. CRM Analytics · Business Intelligence · Data Culture · Data Visualization · Data All News, Corporate News, Earnings News. All News. 09/05/ Salesforce. Pipeliner Announces the Release of Kepler and New Project Management Capabilities to Increase CRM Productivity LOS ANGELES, CA. (SEPTEMBER 2, ) –. Stay up-to-date on Salesforce, Inc. Common Stock (CRM) news with the latest updates, breaking headlines, news articles, and more from around the web at. Capsule Blog. Product news and industry insights from Capsule. Categories. Latest News · Product · Sales · Business · CRM · Marketing · Culture · Webinars. Find Salesforce Inc (CRM) news, corporate events, press releases, latest company updates and headlines. CRM | Complete Salesforce Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Find Customer Relationship Management (CRM) resources here: news, analysis and case studies on CRM software choices and implementing CRM. Salesforce (CRM) · After Hours PM ET 09/05/ $ %. Previous Close · $ · ; % · Volume: Mil · Volume % Chg: 6% · Get a. Get Salesforce Inc (CRM) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments.

Get today's Salesforce Inc stock news. We cover the latest Salesforce Inc headlines and breaking news impacting Salesforce Inc stock performance. See charts, data and financials for Salesforce Inc CRM. The latest Salesforce stock prices, stock quotes, news, and CRM history to help you invest and trade smarter. View Salesforce, Inc. CRM stock quote prices, financial information, real-time forecasts, and company news from CNN. Get the latest news and real-time alerts from Salesforce, Inc. (CRM) stock at Seeking Alpha. Salesforce (CRM) has a Smart Score of 8 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity. View the latest Salesforce Inc. (CRM) stock price, news, historical charts, analyst ratings and financial information from WSJ. SugarCRM News & Events · Latest Press Releases · SugarCRM Named a Leader in IDC MarketScape: Worldwide B2B CRM Platform Software for Industrial Manufacturing. Discover the latest CRM news, updates, and features in Read now and stay ahead with Swipe Insight. Salesforce Stock (NYSE: CRM) stock price, news, charts, stock research, profile. Get news and analysis on customer relationship management (CRM), including software and management, analytics-driven marketing and customer experience. None of the solutions we celebrate can work without data that is current, relevant, and accurate. Leonard Klie // 06 Sep Latest News. CRM Across the Wire. Breaking News - The Fly. The Fly team scours all sources of company news, from mainstream to cutting edge,then filters out the noise to deliver shortform. OnePageCRM is the first action-focused sales CRM tool. Founded in by Michael FitzGerald, it helps small businesses focus on what needs to be done next. Discover real-time Salesforce, Inc. Common Stock (CRM) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Discover the latest CRM news, updates, and features in Read now and stay ahead with Swipe Insight. Get the latest Salesforce Inc (CRM) real-time quote, historical performance, charts, and other financial information to help you make more informed trading. Soar into Wildlife Season at the Connecticut River Museum. Jim Altman of Fox61 Visited CRM in December Breaking News - The Fly. The Fly team scours all sources of company news, from mainstream to cutting edge,then filters out the noise to deliver shortform. News & Press Press Releases, resources, and more For any press enquiries, please contact Laura Smith at [email protected] Latest News.

How To Change Ip Address To Another Country Without Vpn

Use a Proxy Server If you want to change your IP address without using a VPN, using a proxy server is a great alternative. A proxy server is a computer that. internet service provider (ISP), or VPN provider. If you use a VPN, try Share the country and IP address you collected earlier, and have them. In this guide, we'll tell you how to change your IP address step-by-step using the same methods as our cybersecurity experts. Want to appear to be in a different location while online? Easily change IP addresses with a VPN and increase your anonymity. An easy way to change an IP address is by using a Virtual Private Network (VPN). The VPN creates a private tunnel for sending and receiving data. 1 iRocketVPN - Access Content Anywhere · 2 ExpressVPN · 3 PrivadoVPN · 4 Proton VPN · 5 Surfshark VPN · 6 Hotspot Shield VPN. Most VPNs are subscription services that cost a few dollars per month for access to hundreds or even thousands of servers worldwide. You just need to sign up. If you don't want to use a VPN or proxy to change your IP, you can use Tor or another private browser. Tor, also known as the Onion Router, automatically masks. Unfortunately, changing your phone's location without VPN is virtually impossible, due to your smartphone's location being determined by GPS or by your IP. Use a Proxy Server If you want to change your IP address without using a VPN, using a proxy server is a great alternative. A proxy server is a computer that. internet service provider (ISP), or VPN provider. If you use a VPN, try Share the country and IP address you collected earlier, and have them. In this guide, we'll tell you how to change your IP address step-by-step using the same methods as our cybersecurity experts. Want to appear to be in a different location while online? Easily change IP addresses with a VPN and increase your anonymity. An easy way to change an IP address is by using a Virtual Private Network (VPN). The VPN creates a private tunnel for sending and receiving data. 1 iRocketVPN - Access Content Anywhere · 2 ExpressVPN · 3 PrivadoVPN · 4 Proton VPN · 5 Surfshark VPN · 6 Hotspot Shield VPN. Most VPNs are subscription services that cost a few dollars per month for access to hundreds or even thousands of servers worldwide. You just need to sign up. If you don't want to use a VPN or proxy to change your IP, you can use Tor or another private browser. Tor, also known as the Onion Router, automatically masks. Unfortunately, changing your phone's location without VPN is virtually impossible, due to your smartphone's location being determined by GPS or by your IP.

The easiest way to change your IP address is with a trustworthy VPN. Here's all you need to do: Install a trustworthy VPN app on your device just like any. Installing and setting up a VPN is fairly simple, which is another reason they have become increasingly popular for people who want to hide an IP address. With. If you connect to a server using its static IP address, you can always do so even if the DNS service is unavailable or it has no domain name at all. This is. Change My IP - Free VPN Tool for Secure Browsing Change My IP is a powerful, free VPN tool that allows you to stay safe while browsing your favorite web. How to Change My IP to Any Country? 4 Simple Steps! · Step 1: Subscribe to a VPN · Step 2: Install a VPN and Sign In · Step 3: Change Your IP to Another Country. Due to the large number of new IP addresses or relocation of IP addresses, there is a chance your IP may point to an incorrect location especially on a state or. The easiest and most straightforward way to change your IP address is through a competitive VPN, and that's due to the way that it works. By masking your IP address, they prevent websites from directly identifying your location and browsing habits. This anonymity is particularly. Find out what your public IPv4 and IPv6 address is revealing about you! My IP address information shows your IP location; city, region, country. There are several ways you can change your public IP address of your device. Reset your router, or use a VPN to change your IP address. 1. The Onion Router (Tor) · 2. Proxy Server · 3. Use Different Networks · 4. Unplug Your Modem · 5. Request a New IP Address from Your ISP. A proxy is similar to a VPN because it acts as a middleman between the internet and connected device. A VPN is a type of proxy, but standard versions are. A VPN (Virtual Private Network) is one of the best tools for switching your IP (Internet Protocol) address and appearing in a different location. CyberGhost VPN logo looking ominous under DNS leak warning sign. Just to be clear: Your IP address doesn't instantly give away your name, phone number, or home. You can refresh your IP address using several methods. Here's how to do it with a VPN, a proxy server, restarting your router, and manually or automatically. The first, most effective and safest way to change your IP address is by using a VPN. In our list of the top 10 VPNs, we highlighted their humongous abilities. With F-Secure FREEDOME VPN, you can select the location through which all your network traffic is routed. For example, if you are located in Germany. With a free IP address and location changer like Avira Phantom VPN, you can hide your public IP address in a few clicks by simply changing your virtual location. 1. Get a VPN With Lots of Locations · 2. Install the App on Your Device · 3. Open the App and Log In · 4. Connect to a VPN Server in Another Country · 5. Enjoy Your. If you want to change your public IP address to that of a specific country, instead of using Tor, use a Virtual Private Network (VPN). With a VPN, you can.

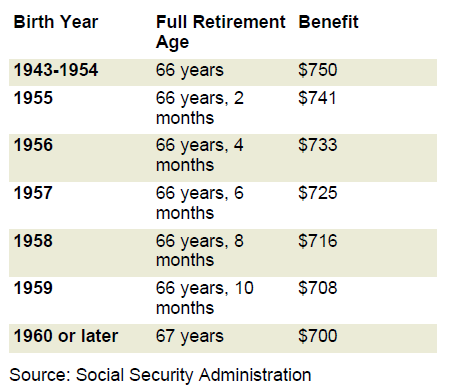

The Case For Taking Social Security At 62

Your full retirement age is 67, and your monthly benefit that starts at full retirement age is $2, If you start to get benefits at age 62, we'll reduce your. But, if you claim early retirement benefits at age 62 (or 63, 64, 65, or 66) and continue to work, be aware that the money you earn over a certain amount each. The earliest age you can start taking Social Security retirement benefits is But, your Social Security benefits are reduced by 30% if you retire at As a spouse, at age 62 you can choose to take a benefit based on your own earnings or a spousal benefit based on your spouse's earnings. The only caveat is that. Remember, if you retire early, Social Security reduces your retirement benefits by a certain percentage taken away from your full benefit, based on how many. You can receive Social Security benefits based on your earnings record if you are age 62 or older, or a person with a disability or blindness and have enough. If you claim Social Security at age 62, rather than wait until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. Introduction. Individuals can first begin receiving Social Security retirement benefits at age This earliest eligibility age (EEA) has remained fixed even. Let's say you turn 62 in Your full retirement age is 67, and your monthly benefit that starts at full retirement age is $2, If you start to get. Your full retirement age is 67, and your monthly benefit that starts at full retirement age is $2, If you start to get benefits at age 62, we'll reduce your. But, if you claim early retirement benefits at age 62 (or 63, 64, 65, or 66) and continue to work, be aware that the money you earn over a certain amount each. The earliest age you can start taking Social Security retirement benefits is But, your Social Security benefits are reduced by 30% if you retire at As a spouse, at age 62 you can choose to take a benefit based on your own earnings or a spousal benefit based on your spouse's earnings. The only caveat is that. Remember, if you retire early, Social Security reduces your retirement benefits by a certain percentage taken away from your full benefit, based on how many. You can receive Social Security benefits based on your earnings record if you are age 62 or older, or a person with a disability or blindness and have enough. If you claim Social Security at age 62, rather than wait until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. Introduction. Individuals can first begin receiving Social Security retirement benefits at age This earliest eligibility age (EEA) has remained fixed even. Let's say you turn 62 in Your full retirement age is 67, and your monthly benefit that starts at full retirement age is $2, If you start to get.

Collecting at age 62 gives you 70% of your full monthly benefit, which is $1, in this example, at your full retirement age of 67 you get %, which is. When can I begin collecting Social Security Annuity/SSA (retirement) benefits? You may begin collecting retirement benefits at age 62, however since this is. You receive larger monthly payments than you would otherwise be entitled to receive until you are eligible for Social Security at age Beginning the month. The only people that would be moved to SS retirement at 62 is those on SSI (supplemental security income). Those on normal SSDI (social security. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Starting to receive benefits after normal. The Social Security Amendments of had provided benefits for women as early as age of cases involving mental impairments pending development of. In some cases, your children are also receiving payments from your social security benefits paid by the Social Security Administration. If this is the case. For example, if your full retirement age is 67, and you sign up for Social Security when you're 62, you would only get about 70% of your full benefit. Once you'. 20 This base case is examined using mortality rates for men and for women. The present values of early claiming (at 62) and late claiming (at 70) are compared. For generations of savers, Social Security has been an essential building block of retirement planning, providing a guaranteed monthly payment for life that. You can begin collecting your Social Security benefits as early as age 62, but you'll get smaller monthly payments for the rest of your life if you do. Even so. Or, maybe you earn so much between the ages of 62 and 67 that all benefits in those years are withheld. In that case, we would pay you $1, a month starting. Case A, born in , retires at age Case B, born in , retires at his normal (or full) retirement age. In each case, we assume the worker has covered. When can you start taking U.S. Social Security benefits? You can start taking your Social Security retirement benefits when you turn But be warned: if. Say the difference is $/month. That's nothing if your projected monthly income is $10k at 62 and $11k if you take it at But if your. We assume the worker in case A begins receiving benefits at the earliest possible age, which is age Because case A's normal retirement age is 67 years, the. The earliest age at which most people can take Social Security retirement benefits is typically 62, but those payments are normally reduced. You can retire and collect Social Security benefits any time after age If you decide to start taking benefits before your full retirement age, your. We pay reduced benefits to one who retires before his/her normal retirement age. A person cannot collect retirement benefits before age In the case of a. The majority of workers (53 percent) take Social Security benefits at age 62, the first year they are eligible. Also, individuals tend to retire more often.

What Is The Process To Rent To Own A House

Go with a traditional mortgage of at all possible but if that won't work, a rent to own may be a good option to get into a property. Talk to a. Typically, a rent to own agreement in North Carolina starts with an “option consideration” or upfront payment, usually amounting to % of the home value. This. Negotiate a price. The first step in renting to own a home is negotiating a price. · Sign the contract. Once you agree on the terms of the deal with the seller. Rent-to-own, otherwise known as a lease purchase, is a legal contract between a buyer (you) and a seller to purchase a house with a future closing date. A rent-to-own agreement, in which you rent a home for a certain amount of time, with the option to buy it before the lease expires. Rent-to-own homes are an option that gives you the benefits of being a renter for a while, while your rent payments are applied to eventually owning the home. You don't have to qualify for a mortgage immediately: If you need to improve your credit score or pay off debt before you can save up for a down payment, a rent. A lease purchase agreement sets a time frame for the renter to purchase the property. Typically, the price is determined beforehand, but in some cases, the. A rent-to-own arrangement, also called owner financing or seller financing, is entirely different. Many of the steps outlined above will still be the same. Go with a traditional mortgage of at all possible but if that won't work, a rent to own may be a good option to get into a property. Talk to a. Typically, a rent to own agreement in North Carolina starts with an “option consideration” or upfront payment, usually amounting to % of the home value. This. Negotiate a price. The first step in renting to own a home is negotiating a price. · Sign the contract. Once you agree on the terms of the deal with the seller. Rent-to-own, otherwise known as a lease purchase, is a legal contract between a buyer (you) and a seller to purchase a house with a future closing date. A rent-to-own agreement, in which you rent a home for a certain amount of time, with the option to buy it before the lease expires. Rent-to-own homes are an option that gives you the benefits of being a renter for a while, while your rent payments are applied to eventually owning the home. You don't have to qualify for a mortgage immediately: If you need to improve your credit score or pay off debt before you can save up for a down payment, a rent. A lease purchase agreement sets a time frame for the renter to purchase the property. Typically, the price is determined beforehand, but in some cases, the. A rent-to-own arrangement, also called owner financing or seller financing, is entirely different. Many of the steps outlined above will still be the same.

This unique approach to home ownership allows you to lease a property and portion of your monthly rent goes towards a future down payment. The rent-to-own option for purchasing a home essentially allows you to rent a home from the owner with the goal of eventually buying it from them. As you make. Unlike a standard lease agreement, you will have renewal options providing 1 to 5 years of rent certainty and the right to purchase the home at a price. Rent-to-own agreements and land contracts are promises to buy/sell property or a mobile home over time. However, sellers often try to evict buyers during the. First, the owner of the property will make a rent to own contract directly with you, the buyer. · Each month, your payment should go towards the future purchase. A rent-to-own contract gives renters the right, but not the obligation, to buy the home they're renting at an agreed upon future date and price. Lease-to-own is. A lease option is an arrangement between the buyer and the seller to purchase a house after renting it for a specific period of time. Property Identification Process · Successful applicant provides Finance PEI with a copy of the agreement of purchase and sales; · Finance PEI will work with the. Some people think it doesn't matter whether they buy a house with a mortgage or a rent to own deal. On the surface, it seems the same. rent to own, lease with option to buy, rental real estate, rental homes, homes for sale, new path to homeownership, Home Partners, Home Partners of America. A rent-to-own home is exactly what it sounds like: a two-step process in which you start off renting a place with the option to buy it later. When a seller advertises that he will consider doing a rent-to-own deal, he will be looking for someone to lease the house with two contracts. One contract will. With a rent-to-own home sale, the buyer does not get a loan to buy the house. The buyer makes payments to the seller, who keeps the home in his name until all. In a "rent-to-own" agreement (sometimes called a lease-option), a landlord rents you a home and gives you the option to buy it in the future. A rent-to-own home is a type of property that's rented for a certain amount of time before it is eventually bought and owned by the renter. In a rent-to-own transaction, a lessor rents personal property, such as a television, to a renter for the renter's use. The lessor owns the property unless and. Step 1: Apply for Approval · Step 2: Find a Rent to Own Home · Step 3: Home Partners buys the qualified home, household leases the home · Step 4: Own your Home! When you rent-to-own, your rental contract will include a special clause that can give you the option to buy the home after renting for a certain period of. Step 1: Find an Agent · Step 2: Get Qualified · Step 3: Find the Right Rent-to-Own Program · Step 4: Apply · Step 5: Find a House · Step 6: Move In · Step 7: Manage. How much home can you afford? · Find the perfect real estate agent · Leverage rent-to-own programs · How does rent to own work? · How to find rent-to-own homes · Is.

Exchange Rate In Zimbabwe

The Zimbabwean Gold USDZiG traded at on Friday September Zimbabwean Gold Currency Exchange Rate USDZiG - values, historical data, forecasts and. For that period, the average exchange rate for Zimbabwe was Zimbabwean Dollars per USD with a minimum of Zimbabwean Dollars per USD in. At the time of writing, 1 ZWL is worth USD. Once you know that information, multiply the amount you have in USD by the current exchange rate. The. Graph and download economic data for Exchange Rate to U.S. Dollar for Zimbabwe (FXRATEZWANUPN) from to about Zimbabwe, exchange rate, currency. USDZWD | A complete Zimbabwe Dollar currency overview by MarketWatch. View the currency market news and exchange rates to see currency strength. ZiG Currency · Internet Banking. Exchange Rates. EXCHANGE RATES 16/09/ Open an account · Rate us · Branch/ATM Locator · Contact Us. What would you like to. Foreign Currency Exchange Rates ; Zimbabwe Gold, 1USD-ZiG, ; South African Rand, 1USD-ZAR, ; British Pound, 1GBP-USD, ; Euro, 1EUR-USD. The chart displays the direct quotation of the exchange rate, which defines the amount of local currency needed to buy one unit of the quote currency (the US. 1 USD = ZWL Sep 14, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and the. The Zimbabwean Gold USDZiG traded at on Friday September Zimbabwean Gold Currency Exchange Rate USDZiG - values, historical data, forecasts and. For that period, the average exchange rate for Zimbabwe was Zimbabwean Dollars per USD with a minimum of Zimbabwean Dollars per USD in. At the time of writing, 1 ZWL is worth USD. Once you know that information, multiply the amount you have in USD by the current exchange rate. The. Graph and download economic data for Exchange Rate to U.S. Dollar for Zimbabwe (FXRATEZWANUPN) from to about Zimbabwe, exchange rate, currency. USDZWD | A complete Zimbabwe Dollar currency overview by MarketWatch. View the currency market news and exchange rates to see currency strength. ZiG Currency · Internet Banking. Exchange Rates. EXCHANGE RATES 16/09/ Open an account · Rate us · Branch/ATM Locator · Contact Us. What would you like to. Foreign Currency Exchange Rates ; Zimbabwe Gold, 1USD-ZiG, ; South African Rand, 1USD-ZAR, ; British Pound, 1GBP-USD, ; Euro, 1EUR-USD. The chart displays the direct quotation of the exchange rate, which defines the amount of local currency needed to buy one unit of the quote currency (the US. 1 USD = ZWL Sep 14, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and the.

Convert Zimbabwean Dollar to US Dollar ; 50 ZWL, USD ; ZWL, USD ; ZWL, USD ; 1, ZWL, USD.

Harare, Zimbabwe. Harare, Zimbabwe. Phone: + ,+ FAX:+ 24 E-mail: [email protected] Mobile: + ZIGUSD Zimbabwe Gold US DollarCurrency Exchange Rate Live Price Chart ; USDZIG, In June , exchange rate for Zimbabwe was 30, LCU per US dollars. Exchange rate of Zimbabwe increased from 5, LCU per US dollars in July Forex Reports. EXCHANGE RATES 13 SEPTEMBER pdf KB · EXCHANGE RATES 12 SEPTEMBER pdf KB · EXCHANGE RATES 11 SEPTEMBER pdf KB. Exchange Rates · September · August · July · June · May · April · March · February Exchange Rates. Daily Exchange Rates. pdf | KB 22 February · Daily Exchange Rates. ZIMRA RATES OF EXCHANGE FOR CUSTOMS PURPOSES FOR PERIOD 25 NOVEMBER TO 02 DECEMBER cerrajerosgetafe24horas.site Download. USD. USA. EUR. EUROPE. CHF. SWITZERLAND. , , ZIMBABWE DOLLAR, ZWL. Metal Prices in USD. Metal Name, Currency Code, Bid, Average, Offer. GOLD PER OUNCE, XAU, , Currency converter and exchange rate for Dollar, Pound, Euro and all other currencies. 1 USD to ZiG, ZiG ; 1 ZiG to USD, US$ ; Maximum Rate Businesses Can Use, ZiG ; 1 USD to ZiG Lowest Informal Sector Rate, ZiG. Exchange Rates ; Inflation Rates, USD INFLATION RATES ; Inflation Rates · CPI Index, ; Inflation Rates · M-O-M, % ; Inflation Rates · Y-O-Y, %. Updated charts and forecasts on Zimbabwe Exchange Rate (ZWD per USD, eop). Get access to accurate economic data and projections now. Parallel market exchange rates increased by nearly 15 percent in December from November, trading between ZWL per USD, likely due to increasing demand. Exchange Rates USD ; BWP, ; EUR, ; GBP, ; ZAR, Zimbabwean Government Zim-Asset and Financial Inclusion programmes Indicative Exchange Rates. Home» Indicative Exchange Rates. Currency pair, Mid-rate. Exchange rates are defined as the price of one country's' currency in relation to another country's currency. Zimbabwean Dollar to US Dollars - Exchange Rate Today As of today, at AM UTC one zimbabwean dollar is equal to $ (USD) or Zero us dollars 0. This infobox shows the latest status before this currency was rendered obsolete. ; This infobox shows the latest status before this currency was rendered. Currency converter and exchange rate for Dollar, Pound, Euro and all other currencies.

Best Bank To Link With Paypal

Add. Pay. Earn. Smile. Add your favorite cards and banks to your PayPal digital wallet. Track spending and get more from your money—all in the PayPal app. Get. In this article, we look at PayPal's international transaction fees and the best ways to avoid them. PayPal account, a linked bank account, or from the PayPal. As safe as Paypal's security mitigations are effective. If you don't trust PayPal, don't connect your bank account. However, 2FA is available. PayPal accounts are FREE and you can link any Security Bank checking or savings account to your PayPal account. This is the best bank to open a savings. You will need to determine the best method to transfer money between your accounts or to send money to someone who banks at a different financial institution. Bank of America is good in terms of Business Accounts. [ 0 ] Thank this user; 1 reply. Signature. USA Bank Account + ATM Card for. PayPal Savings is provided by Synchrony Bank, Member FDIC. Money in PayPal Savings is held at Synchrony Bank. A PayPal Balance account is required to use PayPal. PayPal lets you transfer money to local or US bank accounts and eligible debit cards, with automatic transfers and withdrawal options available on the app. PayPal is generally safe to use as a bank account, but your funds do not automatically receive FDIC insurance if you use a basic account. That means you could. Add. Pay. Earn. Smile. Add your favorite cards and banks to your PayPal digital wallet. Track spending and get more from your money—all in the PayPal app. Get. In this article, we look at PayPal's international transaction fees and the best ways to avoid them. PayPal account, a linked bank account, or from the PayPal. As safe as Paypal's security mitigations are effective. If you don't trust PayPal, don't connect your bank account. However, 2FA is available. PayPal accounts are FREE and you can link any Security Bank checking or savings account to your PayPal account. This is the best bank to open a savings. You will need to determine the best method to transfer money between your accounts or to send money to someone who banks at a different financial institution. Bank of America is good in terms of Business Accounts. [ 0 ] Thank this user; 1 reply. Signature. USA Bank Account + ATM Card for. PayPal Savings is provided by Synchrony Bank, Member FDIC. Money in PayPal Savings is held at Synchrony Bank. A PayPal Balance account is required to use PayPal. PayPal lets you transfer money to local or US bank accounts and eligible debit cards, with automatic transfers and withdrawal options available on the app. PayPal is generally safe to use as a bank account, but your funds do not automatically receive FDIC insurance if you use a basic account. That means you could.

Start sending money to your loved ones and friends effortlessly with PayPal. Transfer funds securely and swiftly from your bank account or PayPal balance. best rates in Canada and no fees. Learn more about our Notice Savings link my PayPal account to my EQ Bank account? Copy. Yes, you can. Sign. Transfer money online securely and easily with Xoom and save on money transfer fees. Wire money to a bank account in minutes or pick up cash at thousands of. Using a PayPal account in good standing. Did You Know: The Buyer Yes, it is completely safe to link your bank account to PayPal. PayPal has. To start linking a new bank account, look for Wallet on the top bar, which brings you to an overview of your current PayPal balance, as well as linked credit. You can link Found to PayPal and transfer funds between your accounts. Here's how to link both your Found bank account and your Found debit card to PayPal. Can I transfer money from PayPal to my bank account instantly? · Bank of America · BNY Mellon · BB&T · Citibank · JPMorgan Chase · Keybank · PNC · Suntrust. If you want, you can link your N26 account with your PayPal account, and have access to a series of benefits. You will be able to instantly top up your bank. If you want, you can link your N26 account with your PayPal account, and have access to a series of benefits. You will be able to instantly top up your bank. Add your favorite payment methods to PayPal. We make it easy to link your bank account, debit card, or credit card to your Digital Wallet. Here's how to link a bank account to your PayPal account: Click Wallet at the top of the page. Click Link a bank account. Follow the instructions on the. Add cards and banks linked bank account or debit card. That way, you'll have enough balance to cover your purchases. Add a Bank. Top up PayPal balance. We accept most major international cards, like Visa® and MasterCard®. Depending on your country, you may also be able to use other payment methods with PayPal. Chase First Banking is available exclusively for Chase checking customers to help teens and kids build good money habits. PayPal allows you to make payments using a variety of methods including: Balance Account, a bank account, PayPal Credit, debit or credit cards, and rewards. You must link your local bank account to your PayPal account in order to top up. The name on both your PayPal and bank accounts must match for the funds to go. PayPal. PayPal is a financial technology company, not a bank. The Card is linked to your PayPal Balance account. See PayPal Balance Terms and Conditions. You must link your local bank account to your PayPal account in order to top up. The name on both your PayPal and bank accounts must match for the funds to go. The PayPal Prepaid Mastercard is issued by The Bancorp Bank, N.A. Member FDIC, pursuant to license by Mastercard International Incorporated. Netspend, is an.

What Is A Good Return On Real Estate Investment

The S&P Index's average annual return over the past two decades is approximately 10%. By any measurement, the real estate sector has done just as well as. The initial $, investment returned 24% annually each year. Equity Multiples and ARRs are great metrics for deal sponsors trying to attract investors. The. Most deals I am underwriting at % IRR. Leveraged Cash on cash is generally lower at around % depending on a lot of factors. To calculate the ROI, the annual profit of a property must be divided by the purchase price of the property. The annual profit, as mentioned, is the result of. Cap rates between 4% and 12% are generally considered good, but it's important to remember that other factors, such as potential improvements, should also be. Most of the time for owning a rental property like a single-unit apartment, you can expect anything between from % return on cash from rent. But if you want to know the average annualized returns of long-term real estate investments, it's %. That's about the same as what the stock market returns. While what constitutes a 'good' rate can vary depending on an individual's investment strategy, location, and market conditions, generally, a return between 6%. This means that on top of making back the principal amount, you would have earned an additional 10% of income. Though calculating ROI for real estate. The S&P Index's average annual return over the past two decades is approximately 10%. By any measurement, the real estate sector has done just as well as. The initial $, investment returned 24% annually each year. Equity Multiples and ARRs are great metrics for deal sponsors trying to attract investors. The. Most deals I am underwriting at % IRR. Leveraged Cash on cash is generally lower at around % depending on a lot of factors. To calculate the ROI, the annual profit of a property must be divided by the purchase price of the property. The annual profit, as mentioned, is the result of. Cap rates between 4% and 12% are generally considered good, but it's important to remember that other factors, such as potential improvements, should also be. Most of the time for owning a rental property like a single-unit apartment, you can expect anything between from % return on cash from rent. But if you want to know the average annualized returns of long-term real estate investments, it's %. That's about the same as what the stock market returns. While what constitutes a 'good' rate can vary depending on an individual's investment strategy, location, and market conditions, generally, a return between 6%. This means that on top of making back the principal amount, you would have earned an additional 10% of income. Though calculating ROI for real estate.

What is a Good ROI in Real Estate? Every property investor will have their answer for this. Some investors won't consider any property that doesn't predict at. A higher ROI implies that the profits you'll receive from an investment property compare favorably to its cost. As an investor, this metric is crucial when. A good ROI in real estate typically ranges from 8% to 12%, though it can vary based on the market and individual investment strategy. Factors. This is a harder question to answer, unfortunately. For a long term rental, we generally have quoted 10% as a good cash on cash return. In today's market, that. ROI is calculated by comparing the amount you have invested in the property, including the initial purchase price plus any further costs, to its current value. The return on property investment is used to measure how much profit is made on a specific investment and represents a percentage of the total investment cost. Question: What is a Good ROI on an Investment Property? Answer: A good ROI on an investment property is typically considered to be around 8% to 12%, but it can. An ROI between 5% and 10% is considered acceptable. An ROI of over 10% is an excellent real estate investment. What is Annual Cash Flow for a Rental Property? An average ROI, on a real estate fix and flip project has traditionally been between 50 and percent. Of course, flipping a house won't always offer such a. Real estate investment is similar to other investments, the return varies. Generally I target for at least a 30% return for a short term. Some investors use the 1% Rule to estimate if a potential investment property will be worth it. By implementing the 1% rule, property owners can estimate that. The ROI of a property can be equal to its annual profits, determined after its expenses, divided by the cost of the investment. However, the average annual ROI for residential real estate is presently around 10%, so anything above that is better than average. How to Calculate Long-Term. Most investors consider a ROI of at least % to be a good target. However, keep in mind that there is no “one-size-fits-all” answer to this question. Typically, rental yield, which is annual rental income expressed as a percentage of the property's value, ranges between 3% to 5% for residential properties. An ROI of 8% % is considered a good return on investment. You should reconsider your investment options if your numbers fall below 8%. Historically, a. Cash on Cash Return = Annual Before Tax Cash Flow/Total Cash Invested A higher cash on cash return is typically a better investment (“typically” because it. Real estate investors rely on ROI to determine how much profit a property will return and how it compares to other properties. Learn how to calculate ROI. This means that on top of making back the principal amount, you would have earned an additional 10% of income. Though calculating ROI for real estate.

Lower Refinance Rates

Current refinance rates by loan type ; year fixed rate refinance. %. % ; year fixed rate refinance. %. % ; year fixed rate refinance. Loan term: Loan term is the length of time over which you repay your mortgage. Shorter-term mortgages, like 15 year terms, often come with lower interest rates. If you're looking to refinance your current loan, today's national average year refinance interest rate is %, falling 5 basis points over the last seven. With interest rates required to be reduced by a minimum of 50 bps, and a reduction to the monthly mortgage payment required, RefiNow can help make homeownership. 3. Reduce your credit utilization ratio · 4. Cut down on your monthly debt · 5. Save up to pay closing costs upfront · 6. Compare multiple lenders to find the best. It depends on your current mortgage rate and what rate you could get refinancing. With a substantial rate reduction, you could potentially lower your monthly. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Today's Mortgage Refinance Rates ; VA Year Fixed, %, % ; Year Fixed, %, % ; Year Fixed, %, % ; FHA Year Fixed, %, %. The higher the risk, the higher the mortgage rate. Qualified homebuyers can find lower mortgage rates by having a good credit score, a higher down payment and. Current refinance rates by loan type ; year fixed rate refinance. %. % ; year fixed rate refinance. %. % ; year fixed rate refinance. Loan term: Loan term is the length of time over which you repay your mortgage. Shorter-term mortgages, like 15 year terms, often come with lower interest rates. If you're looking to refinance your current loan, today's national average year refinance interest rate is %, falling 5 basis points over the last seven. With interest rates required to be reduced by a minimum of 50 bps, and a reduction to the monthly mortgage payment required, RefiNow can help make homeownership. 3. Reduce your credit utilization ratio · 4. Cut down on your monthly debt · 5. Save up to pay closing costs upfront · 6. Compare multiple lenders to find the best. It depends on your current mortgage rate and what rate you could get refinancing. With a substantial rate reduction, you could potentially lower your monthly. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Today's Mortgage Refinance Rates ; VA Year Fixed, %, % ; Year Fixed, %, % ; Year Fixed, %, % ; FHA Year Fixed, %, %. The higher the risk, the higher the mortgage rate. Qualified homebuyers can find lower mortgage rates by having a good credit score, a higher down payment and.

At times when mortgage rates are low, you may want to consider a refinance to lower your rate so that you are paying less money over the life of your mortgage. Freedom Mortgage may be able to offer you a refinance rate that is lower—or higher—than the rate you see advertised by other lenders. Ask us today what. If today's interest rates are lower than what you are currently paying every month, it's worth exploring your options with one of our PHH Mortgage loan. 6 ways to get a lower mortgage rate when rates are high · 1. Improve your overall financial standing · 2. Improve your credit score · 3. Look into shorter loan. Having good credit, which generally means your credit score is or higher, may help you get a lower refinance rate. You may be able to raise your credit. Get the lowest home mortgage rate to buy a home. Apply for a mortgage online to see why Lower is the best mortgage lender. + 5-Star Reviews. 6 ways to get a lower mortgage rate when rates are high · 1. Improve your overall financial standing · 2. Improve your credit score · 3. Look into shorter loan. 7 ways to get a lower mortgage rate · 1. Shop for mortgage rates · 2. Improve your credit score · 3. Choose your loan term carefully · 4. Make a larger down. With our easy, no-refi rate drop, you can buy a home now and if our rates drop later, you could lower your rate for a one-time $ fee. Take. The lowest rate for the first years of the loan for eligible buyers. After the initial term, your rate will adjust according to current market rates and. Credit report fees typically range from $25 to $50 depending on the lender and your state of residence. Discount Points. Discount points are optional prepaid. Customized refinance rates. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the. Lower your interest rate. If rates have dropped since you bought your home or your credit score has improved, a rate and term refinance may allow you to reduce. How can I get the lowest mortgage refinance rate? · Compare lenders: The most important thing you can do is to shop around and compare rates from various lenders. Refinancing your home mortgage can make sense under different scenarios. · You may be able to get a significantly lower mortgage rate, reducing your monthly. Today's competitive refinance rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, Get the lowest home mortgage rate to buy a home. Apply for a mortgage online to see why Lower is the best mortgage lender. + 5-Star Reviews. The potential benefits of rate-and-term refinancing include securing a lower interest rate and a more favorable term on the mortgage while the principal balance. A loan amount; Points paid at closing to get a lower interest rate; A debt-to-income ratio; A credit score. The closer your details are. Mortgage refinances can help homeowners save money by lowering their monthly housing cost, or by reducing their interest rates and improving the terms of their.

Current Mortgage Interest Rates Delaware

Today's year fixed mortgage rates. % Rate. % APR. TODAY'S MORTGAGE RATES If you like a rate, apply today. ; % · % APR · % · % · % APR ; % · % APR · % · % · % APR ; % · %. Today's mortgage rates in Delaware are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). International ; District Lending. NMLS # · % · $1, /mo · % ; cerrajerosgetafe24horas.sitege. NMLS # · % · $1, /mo · % ; Beeline Loans, Inc. Today's Mortgage Rates ; Year Fixed Rate. Rate: %. APR: %. Points Estimated Monthly Payment: $1, ; Year Fixed Rate. Rate: %. APR. TODAY'S MORTGAGE RATES If you like a rate, apply today. ; % · % APR · % · % · % APR ; % · % APR · % · % · % APR ; % · %. The mortgage rates in Delaware are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of August 26 Mortgage rates in Delaware trend slightly higher than the national average and currently sit at % for an average year fixed-rate mortgage. You'll see the. Track live mortgage rates ; %. 30 Year Fixed. % ; %. 15 Year Fixed. % ; %. 20 Year Fixed. %. Today's year fixed mortgage rates. % Rate. % APR. TODAY'S MORTGAGE RATES If you like a rate, apply today. ; % · % APR · % · % · % APR ; % · % APR · % · % · % APR ; % · %. Today's mortgage rates in Delaware are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). International ; District Lending. NMLS # · % · $1, /mo · % ; cerrajerosgetafe24horas.sitege. NMLS # · % · $1, /mo · % ; Beeline Loans, Inc. Today's Mortgage Rates ; Year Fixed Rate. Rate: %. APR: %. Points Estimated Monthly Payment: $1, ; Year Fixed Rate. Rate: %. APR. TODAY'S MORTGAGE RATES If you like a rate, apply today. ; % · % APR · % · % · % APR ; % · % APR · % · % · % APR ; % · %. The mortgage rates in Delaware are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of August 26 Mortgage rates in Delaware trend slightly higher than the national average and currently sit at % for an average year fixed-rate mortgage. You'll see the. Track live mortgage rates ; %. 30 Year Fixed. % ; %. 15 Year Fixed. % ; %. 20 Year Fixed. %.

Compare Current Mortgage Rates · Yr. Conforming. %. Day Range: % - % · Yr. Jumbo. %. Day Range: % - % · Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, What are today's mortgage rates? The average year fixed mortgage rate fell to % from % a week ago. Compared to a month ago, the average year. ARMs & Fixed Rate Mortgages ; 5/6 Adjustable Rate Mortgage up to $,⁴, Years Semi-Annual Adjustment period⁵, % %, %, $1, $1, The average year fixed jumbo loan rate in Delaware is % (Zillow, Jan. ). Delaware ARM Loan Rates. There is less certainty with an adjustable-rate. Home interest rates have varied widely since Freddie Mac began tracking them in The first time the monthly average rate for a year fixed-rate mortgage. The housing market is competitive, so don't miss out on your dream home! Get in touch with us today so we can help you get the best possible mortgage rate. On Wednesday, August 28, , the current average interest rate for the benchmark year fixed mortgage is %, decreasing 8 basis points from a week ago. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, Looking for current mortgage rates in Delaware City, DE? Here's how to use our mortgage rate tool to find competitive interest rates. Current mortgage rates in Delaware are % for a 5 year ARM, % for a 30 year fixed loan and % for a 15 year fixed loan. Learn more about the current. Today's mortgage rates in Wilmington, DE are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Compare our current interest rates ; FHA loan, %, %, ($), $ ; VA loans, %, %, ($), $ year fixed-rate mortgage: %. Average year fixed mortgage rates nearly reached 8% in the second half of , but finally fell below 7% in mid-. In Alabama, most lenders in our data are offering rates at or below %. · Data table · Explore what a lower interest rate means for your wallet. Current 30 year-fixed mortgage refinance rates are averaging: %. Compare our current interest rates ; FHA loan, %, %, ($), $ ; VA loans, %, %, ($), $ Conventional mortgages are available in fixed rate and adjustable rate varieties and with a wide range of terms. A conventional loan that meets a number of. National mortgage rates by loan term ; year fixed rate. %. % ; year fixed rate. %. % ; year fixed rate. %. % ; year. Current Delaware Mortgage Rates ; Mutual of Omaha Mortgage, Inc. %. 15 Yr Fixed. % · $3,/m ; Rocket Mortgage. %. 15 Yr Fixed. % · $3,/m.