cerrajerosgetafe24horas.site

Gainers & Losers

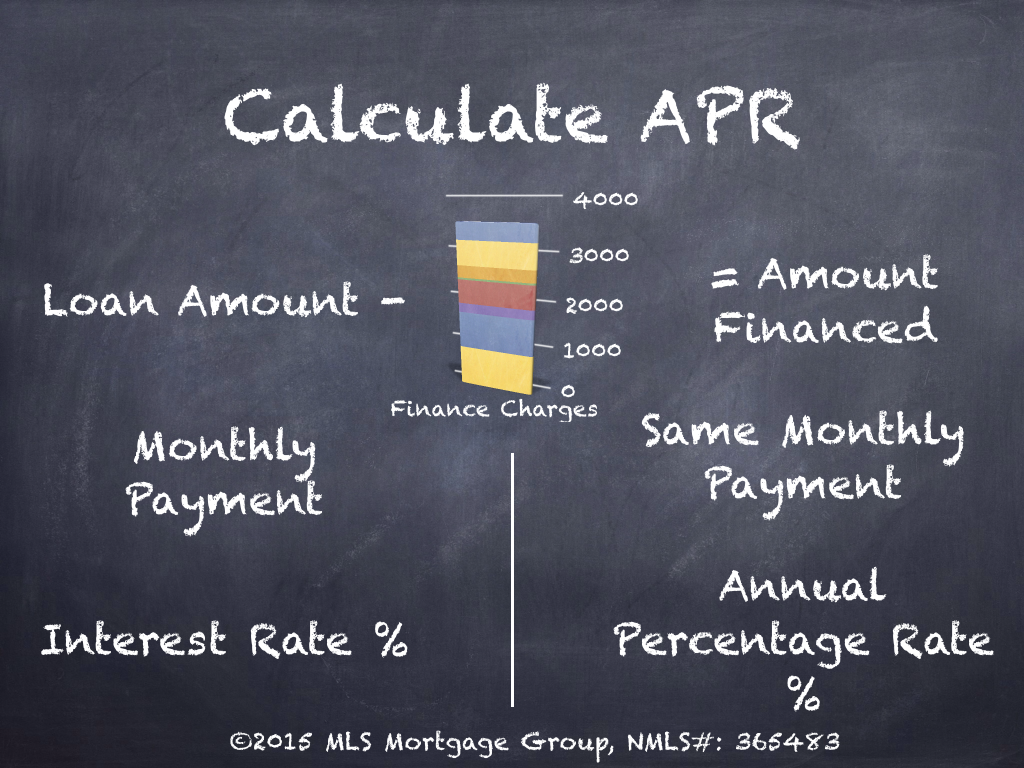

How To Get A Lower Apr On Mortgage

The interest rate of an adjustable-rate mortgage (ARM), however, fluctuates throughout the life of the loan, based on a specific economic metric, such as LIBOR. 1. Choose a Few Mortgage Lenders to Shop With · 2. Compare Rates on Different Types of Mortgages · 3. Consider Less-Common Rates and Terms · 4. Get Loan Estimates. One trick is to use half payments on your mortgage. For example, if your mortgage is $3, a month, why not pay $1, every two weeks? You'll end up making. Negotiate Directly with Your Credit Card Issuer · Balance Transfer Credit Cards · Opt for a Debt Consolidation Loan · Improve Your Credit Score · Consider a Credit. A low closing cost or “no-closing-cost” loan with higher interest rate will lead to a lower APR. However, when paying loan closing costs, including paying. If you plan to live in your home for 30 years, a low interest rate might be the most important factor. You might be willing to pay points that will lower your. The answer to getting a lower monthly mortgage payment on a fixed loan is - maybe - to refinance. If you refinance when interest rates are low . Choose a shorter mortgage term. Shorter term loans (15 years vs. 30 years) come with lower interest rates because the lender is enduring less risk in this. What to do to get the best deal on your mortgage · 1. Talk to multiple lenders · 2. Watch out for hidden discount points and fees · 3. Know which closing costs are. The interest rate of an adjustable-rate mortgage (ARM), however, fluctuates throughout the life of the loan, based on a specific economic metric, such as LIBOR. 1. Choose a Few Mortgage Lenders to Shop With · 2. Compare Rates on Different Types of Mortgages · 3. Consider Less-Common Rates and Terms · 4. Get Loan Estimates. One trick is to use half payments on your mortgage. For example, if your mortgage is $3, a month, why not pay $1, every two weeks? You'll end up making. Negotiate Directly with Your Credit Card Issuer · Balance Transfer Credit Cards · Opt for a Debt Consolidation Loan · Improve Your Credit Score · Consider a Credit. A low closing cost or “no-closing-cost” loan with higher interest rate will lead to a lower APR. However, when paying loan closing costs, including paying. If you plan to live in your home for 30 years, a low interest rate might be the most important factor. You might be willing to pay points that will lower your. The answer to getting a lower monthly mortgage payment on a fixed loan is - maybe - to refinance. If you refinance when interest rates are low . Choose a shorter mortgage term. Shorter term loans (15 years vs. 30 years) come with lower interest rates because the lender is enduring less risk in this. What to do to get the best deal on your mortgage · 1. Talk to multiple lenders · 2. Watch out for hidden discount points and fees · 3. Know which closing costs are.

The more money you put down, the more stake you have in the property. Loan term: Shorter terms (like a year or a year) generally have smaller interest. Tips to get a lower-APR card · Use your current card responsibly and pay your bills on time. Late payments can have a negative effect on your credit. · Avoid. Mortgage points are fees paid to the lender for a reduced interest rate Buying points to lower your monthly mortgage payments may make sense if you. One discount point costs 1% of your loan amount. While one point will typically reduce the interest rate by less than 1%, even a small interest rate reduction. Strategies that may help reduce monthly payments · Lower your rate. · Consolidate your debt. · Extend the length of your loan. · Compare debt pay down strategies. If negotiating with your credit card company fails, you can get a lower rate by applying for a new card that offers an intro 0% APR. The best 0% APR credit. Aim to maintain a high credit score, as this gives you more leverage in negotiations and can result in a lower interest rate on your mortgage loan. Shopping. A low closing cost or “no-closing-cost” loan with higher interest rate will lead to a lower APR. However, when paying loan closing costs, including paying. One discount point costs 1% of your loan amount. While one point will typically reduce the interest rate by less than 1%, even a small interest rate reduction. Call a broker. They have s of banks and loan options available for them to pair you up with. They're free (they get commission from the bank). If rates drop and you decide to buy a home, there's another way to get an even lower interest rate: buying discount points. Mortgage discount points are. If rates drop and you decide to buy a home, there's another way to get an even lower interest rate: buying discount points. Mortgage discount points are. * Points are equal to 1% of the loan amount and lower the interest rate. make home buying possible even before mortgage rates trend more meaningfully lower.”. If you haven't checked your credit report recently, do so now. If you find errors, get them corrected before you apply for a mortgage. Check your credit report. Here's a look at things you can do to score a lower interest rate on a personal loan and save money while you pay it off. You can buy down your interest rate by up to percent to reduce your interest costs and get a lower payment. Before you choose to complete a rate buydown. The Low Interest Rate Program provides qualified low and moderate income first time home buyers with low down payment mortgage financing on one to four family. If you have a solid credit score, you can potentially collect some competitive offers with lower interest rates. In other words, show your credit card company. Historically, the rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1%.

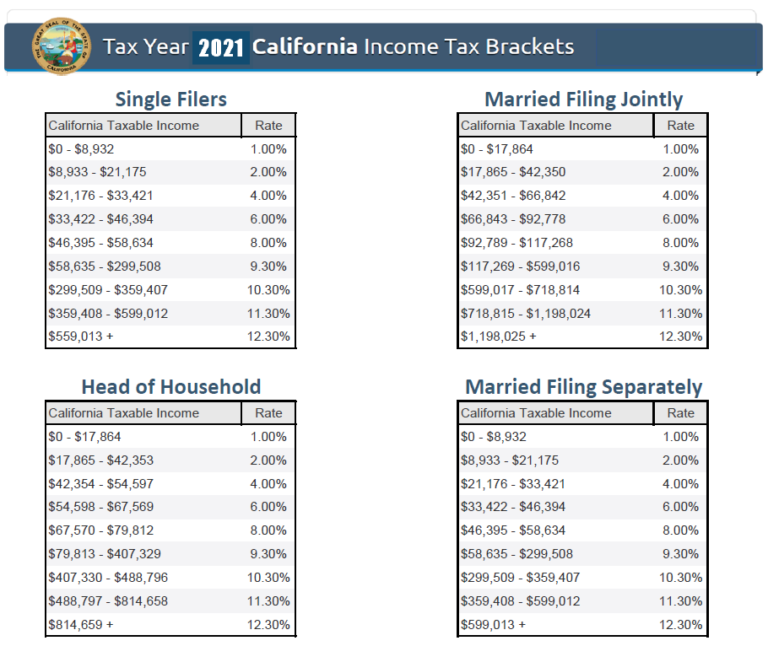

California State Income Tax Table

Withholding Formula >California Effective ). California provides two methods for determining the amount of wages and salaries to be withheld for state personal income tax. The state income tax rates range from 1% to %, and the sales tax rate is % to %. California offers tax deductions and credits to reduce your state. The California (CA) state sales tax rate is %. This rate is made up of a base rate of 6%, plus a mandatory local rate of % that goes directly to city. and/or DE 4 takes effect, compare the state income tax withheld The California Employer's Guide, DE 44, provides the income tax withholding tables. California has ten marginal tax brackets, ranging from 1% (the lowest California tax bracket) to % (the highest California tax bracket). Each marginal rate. Sales tax · % – State. % – State – General Fund; % – State – Local Public Safety Fund; % – State – Local Revenue Fund for local health and. OVER FOR CALIFORNIA STATE ANNUAL TAX RATES AND OTHER RATES. STANDARD The IRS encourages everyone to use their Tax Withholding Estimator located at https://www. California has ten income tax brackets from 1% up to %. Technically, the last tax bracket is %, but there is also an additional 1% for those with a. Withholding Formula >California Effective ). California provides two methods for determining the amount of wages and salaries to be withheld for state personal income tax. The state income tax rates range from 1% to %, and the sales tax rate is % to %. California offers tax deductions and credits to reduce your state. The California (CA) state sales tax rate is %. This rate is made up of a base rate of 6%, plus a mandatory local rate of % that goes directly to city. and/or DE 4 takes effect, compare the state income tax withheld The California Employer's Guide, DE 44, provides the income tax withholding tables. California has ten marginal tax brackets, ranging from 1% (the lowest California tax bracket) to % (the highest California tax bracket). Each marginal rate. Sales tax · % – State. % – State – General Fund; % – State – Local Public Safety Fund; % – State – Local Revenue Fund for local health and. OVER FOR CALIFORNIA STATE ANNUAL TAX RATES AND OTHER RATES. STANDARD The IRS encourages everyone to use their Tax Withholding Estimator located at https://www. California has ten income tax brackets from 1% up to %. Technically, the last tax bracket is %, but there is also an additional 1% for those with a.

Workshop: California State Income Tax Filing. Attend one Schedule to determine Total Income and Deductions and California Source Income and Deductions. The California Tax Estimator Lets You Calculate Your State Taxes For the Tax Year California State Income Tax Rate for Current Tax Year: %. The California. California Nonresident WithholdingNon-wage payments to nonresidents of California are subject to 7% state income tax withholding if the total payments. Withholding federal income tax based on the tax table. An California state income tax, you may request CalSTRS to withhold state income taxes. How do California tax rates compare nationally? CA has a graduated state individual income tax, with rates ranging from percent to percent. OVER FOR CALIFORNIA STATE ANNUAL TAX RATES AND OTHER RATES All employees updating their IRS Form W-4 must now also complete a California State Withholding. Do not withhold based on the tax table. Do not withhold California state income tax. SIGNATURE. SIGNATURE. DATE. Send to: UC RASC—Retirement Administration. The tax rates in California range from % to %. Your tax bracket determines the rate you will pay on your taxable income. California's tax brackets range. Income tax rates in California vary based on an individual's income and range from 1% to %, with higher rates applying to individuals with higher income. California has ten marginal tax brackets, ranging from 1% (the lowest California tax bracket) to % (the highest California tax bracket). Each marginal rate. Before you file your California state income taxes, read this. You might be surprised to learn what types of earnings are considered taxable. The highest tax rate of % for income over $, (Single/MFS), $, (HOH), and $1,, (MFJ). Tax Rate. Filing Status. Income Range. Taxes Due. Tax. But those earning in excess of $, annually must pay a percent tax rate. To determine rates for dual filers (such as married couples filing jointly). (Note that the line from the inner black pie chart intersects with the sales and use tax segment to show the shares of sales tax revenue that go to the state. OR. Withhold California state income tax. Withhold California state income tax based on the tax tables for. (choose one). Single with _____ (Enter 0 or number. California Earned Income Tax Credit and Young Child Tax Credit. With this Additionally, the effective tax rate — the share of overall income paid in tax. Overview of California's state and local expenditure and revenue sources. Each state allocates spending and taxes differently among different levels of. Workshop: California State Income Tax Filing. Attend one Schedule to determine Total Income and Deductions and California Source Income and Deductions. income tax burden for each state at different income levels. DOTAX collected information about the marginal tax rates, standard deduction, personal.